Swiss Bond Congress

Together with Fisch Asset Management, we have been organizing the most important Swiss event for institutional bond investors on a regular basis since 2003. The Swiss Bond Congress is the meeting place for institutional bond investors, risk managers and selected issuers. The event is now in its eleventh year and offers a varied programme with top-class speakers, exciting specialist presentations, plenary discussions and practice-oriented workshops.

Over 120 participants representing several hundred billion Swiss francs in assets under management as well as selected members of the financial press appreciate the opportunity to directly engage with industry experts and company representatives and are delighted by the quality of the line-up and the informal atmosphere.

Outlook – 11th Swiss Bond Congress: 19 September 2024

The financial markets are currently caught between inflation risks, an economic slowdown and geopolitical flashpoints. Undeterred by this, the stock markets are rising and credit risk premiums are narrowing further. The latter no longer offer any buffer for the unforeseen. This is precisely where we are keeping our finger on the pulse, as corporate forecasts are becoming more cautious and consumers more restrained, while the disruptive factors remain manifold. What will happen if inflation rises again, geopolitical crises spread further or the higher interest rates have a greater impact on the economy? How much longer will the capital markets tolerate the escalating debt levels of Western countries?

We will get to the bottom of these and other questions at the 11th Swiss Bond Congress. We will categorise the situation on the bond and credit markets, discuss the implications for portfolio and risk managers and point out possible solutions. At the same time, you will hear first-hand the credit story of well-known capital market borrowers, while credit analysts and market experts will present a differentiated view of opportunities and credit risks for countries, companies and banks.

Main event programme

| 08:15 | Door opening | |

| 08:30 | Welcome and introduction | Independent Credit View – Christian Fischer, CEO & Senior Partner |

| 08:40 | Credit markets: Current environment for countries, corporates and banks | Independent Credit View – René Hermann, COO & Senior Partner (Sovereign) – Andrea Giuseppe Frey, Senior Credit Analyst (Corporates) – Guido Versondert, Senior Credit Analyst (Banks) |

| 09:15 | Company presentation | Stadler Rail – Raphael Widmer, Group CFO (Biography) |

| 09:50 | Coffee break | |

| 10:10 | Keynote: Europe – debt without atonement? | Professor Dr. Jürgen Stark Former Chief economist of the European Centralbank Biography |

| 10:55 | Panel discussion: Interest Rate Environment & Debt What do credit investors need to prepare for? | Moderation: – Mark Dittli, Chefredaktor The Market Guests: – Matthias Geissbühler, CIO Raiffeisen CH (Biography) – Prof. Dr. Jürgen Stark – Beat Thoma, CIO Fisch AM (Biography) – Michael Best, Berlin Global Advisors (Biography) |

| 12:00 | Lunch break | Standing lunch |

| 13:15 | Swissness reloaded: Extra return with CHF bonds | Fisch Asset Management – Thomas Fischli-Rutz, Portfolio Manager (Biography) |

| 13:50 | Company presentation | Deutsche Pfandbriefbank – Götz Michl, Head of Funding & Debt Investor Relations (Biography) |

| 14:25 | Property market and banks: Ominous correlation? | Independent Credit View – Michael Dawson-Kropf, Senior Credit Analyst – Marc Meili, Senior Credit Analyst und Partner |

| 15:00 | Coffee break | |

| 15:20 | Credit risk premiums without safety margin: Are investors too careless with corporate bonds? | Independent Credit View – Fabian Keller, Head of Research & Senior Partner |

| 15:55 | Impulse Note Geopolitics: How do we face the new world order? | Michael Best Partner at Berlin Global Advisors |

| 16:05 | Geopolitics panel discussion: Geopolitics as the biggest tail risk for bond markets? | Moderation: – Mark Dittli, Chefredaktor The Market Guests: – Thomas Fischer, CIO Berner KB (Biography) – Beat Thoma, CIO Fisch AM – Michael Best, Berlin Global Advisors – Guido Versondert, Senior Credit Analyst I-CV |

| 16:45 | Wrap-up & Apéro | Independent Credit View – Christian Fischer, CEO & Senior Partner |

Registration

The event is aimed at institutional investors, portfolio and risk managers. The costs of the event will be borne in full by the organisers. Due to the limited number of participants, please register by 30 August 2024 at the latest.

Public transport

The Metropol is easily accessible by tram lines no. 2, 8, 9 and no. 11 (stop ‘Kantonalbank’) from Zurich main station or Stadelhofen station.

Car

There are numerous multi-storey car parks in the vicinity, including Fraumünsterstrasse, Münsterhof, Urania, Hohe Promenade and Utoquai car parks.

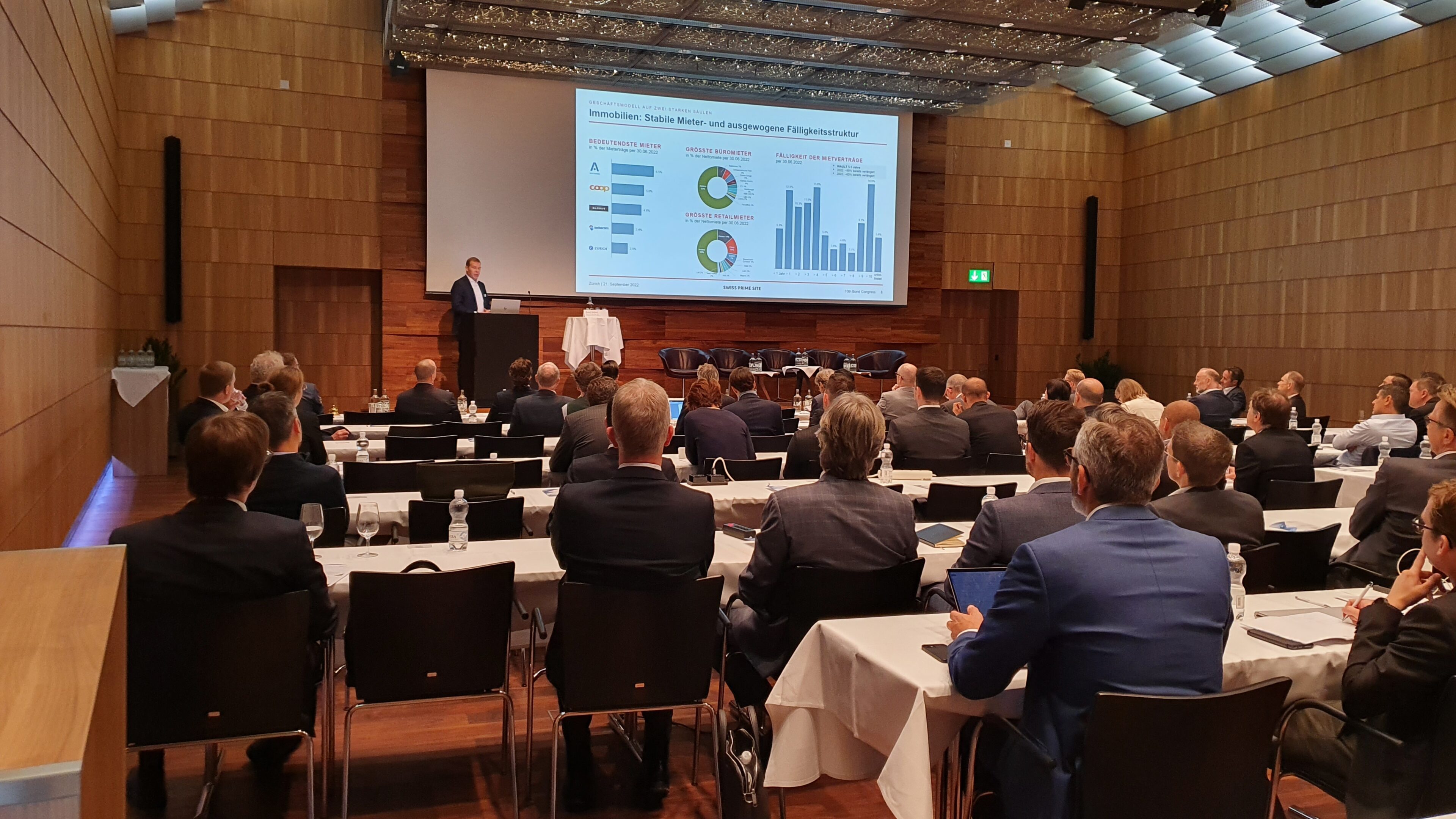

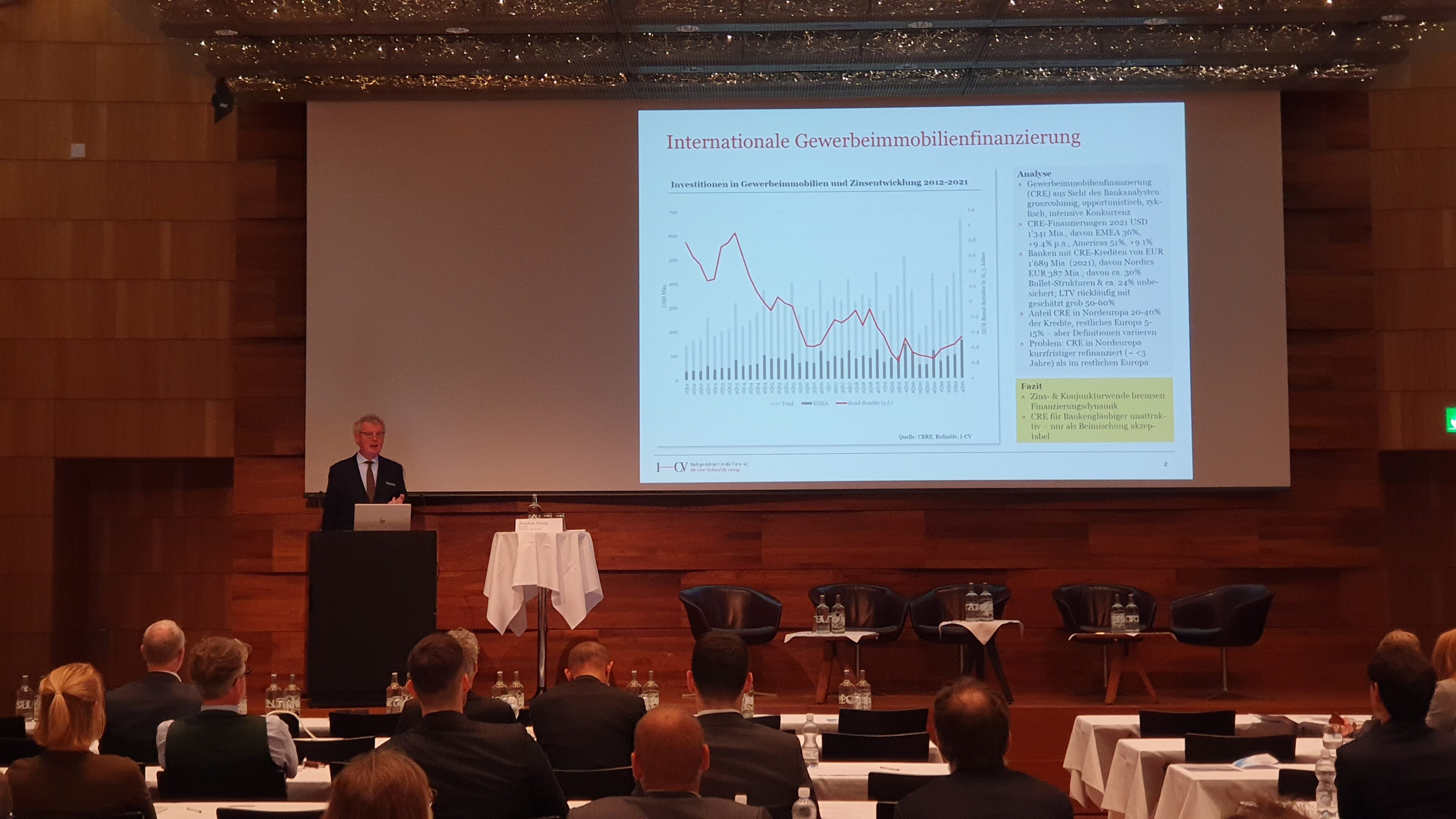

Review – 10th Swiss Bond Congress on September 21st, 2022 at Metropol Zürich

Presentations (in German)

- Prof. Dr. Reiner Eichenberger – Schweiz und Europa – Risiken in Wirtschaft und Politik”

- René Hermann “I-CV: Länderstudie 2022”

- René Zahnd “Swiss Prime Site AG”

- Daniel Ducrey “Mobimo Management AG“

- Maria Stäheli – Fisch Asset Management “Investment Grade Credit im Licht historischer Drawdowns”

- Jesus Martinez “Iberdrola“

- Fabian Keller “I-CV: Chancen und Risiken im Kreditzyklus”

- Stephan Denig “Grenke”

- Guido Versondert “I-CV: Banken im Spannungsfeld”

Workshops (in German)

Impressionen